USCIS Implements H-1B Electronic Registration for the fiscal year 2021 cap

On Dec. 6, 2019, United States Citizenship and Immigration Services (USCIS) announced the implementation of the electronic registration process for the fiscal year 2021 cap season. All employers seeking to file H-1B petitions during the fiscal year 2021 cap must electronically register and pay the required $10 H-1B registration fee.

USCIS’ electronic registration runs from March 1, 2020 to March 20, 2020. Employers subject to the cap must complete a separate registration for each worker for whom they want to sponsor. If enough registrations are received, the USCIS will randomly select from those electronic registrations. Only registrations selected during that process will be eligible to file H-1B petitions and only for those workers named in the selected registrations.

In prior cap seasons, employers mailed their petition to the USCIS before knowing if the petition was selected in the cap. Now, only those selected during the registration process will submit a full petition. Accordingly, the electronic registration should provide overall cost savings to employers filing H-1Bs.

USCIS will post detailed instructions on the electronic registration closer to the March registration period.

Premium Processing Price Increases

USCIS has announced that as of Dec. 2, 2019 the filing fee to request premium processing service will increase to $1,440. Premium processing is available to certain Form I-140, Immigrant Petition for Alien Worker, filings and Form I-129, Petition for a Nonimmigrant Worker, which is used to request H-1B (specialty worker), L (intra-company transfer), O-1 (extraordinary ability), etc. status. A petition which has a request for premium processing should be adjudicated within 15 calendar days unless a Request for Evidence is issued. This is a sharp contrast to the standard processing time for these petitions, which typically have a standard processing time which vary from 5.5– 12 months.

ICE Taking a Closer Look at OPT

U.S. Immigration and Customs Enforcement (ICE) has taken two steps recently that demonstrate that it is taking a closer look at Optional Practical Training (OPT) when it comes to compliance. First, reports have been received of on-site inspections conducted where the person has STEM OPT. STEM OPT is 24 months of post-graduation work authorization which has very specific eligibility requirements. The STEM OPT regulation authorizes these inspections, and the Department of Homeland Security (DHS) has issued information about the scope of the visits. Second, new policy guidance was recently issued, “Practical Training: Determining a Direct Relationship Between Employment and a Student’s Major Area of Study” which applies to OPT and STEM OPT. Read the article here. This guidance explains that F-1 students engaged in practical training are responsible for describing of how their job duties relate to their major area of study, which their designated school official (DSO) must review and retain in the student’s file.

Backpay Awarded Due to Failure to Notify CIS

USCIS regulations require that an employer notify the USCIS when there is a change in the terms and conditions of employment, which may affect continued eligibility for H-1B status. H-1B status authorizes employment in a specialty occupation, which is defined as a job that requires a least a bachelor’s degree or the equivalent in a specific field. The regulations also state that “if the petitioner no longer employs the beneficiary, the petitioner shall send a letter explaining the change(s) to the director who approved the petition.” While USCIS does not typically enforce this requirement, the Department of Labor (DOL) has taken the view that an employer has not truly terminated an H-1B employee unless they have notified the USCIS as required under USCIS’ regulations. Recently, ME Global Inc. of Columbia Heights, MN, paid a former employee $190,357 in back wages and interest after a DOL Wage & Hour Division (WHD) investigation found it had failed to offer the employee transportation home and failed to withdraw his Labor Condition Application (LCA) with USCIS upon termination of employment. WHD found that the back wages were owed from the date of termination to the date the employee left the U.S. This serves as an important reminder to employers of their obligations under the LCA to offer the employee transportation home if the employer terminates prior to the expiration of the H-1B and to notify USCIS if there is a termination.

TPS Extensions

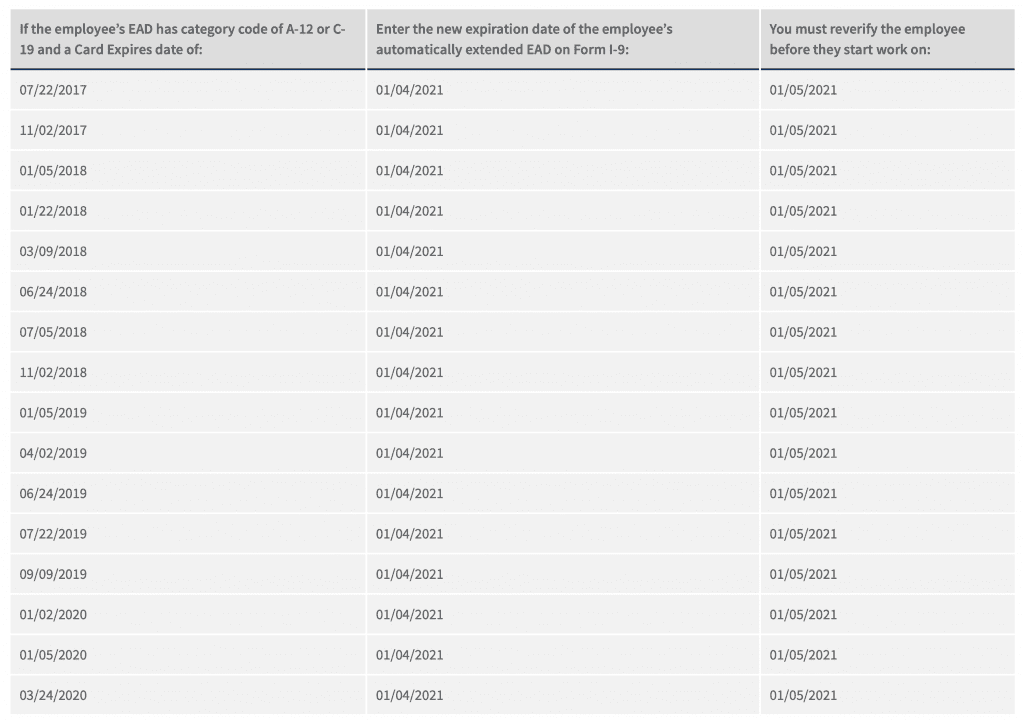

DHS announced on Nov. 5, 2019 that it was extending the validity of Temporary Protected Status (TPS) -related documentation such as Employment Authorization Documents (EADs); Forms I-797, Notice of Action; and Forms I-94, Arrival/Departure Record for beneficiaries under the TPS designation for El Salvador, Haiti, Honduras, Nepal, Nicaragua and Sudan through Jan. 4, 2021. Employers completing or updating Forms I-9 can use the following chart prepared on E-Verify’s website to update or complete new I-9 forms to reflect this automatic extension of employment authorization:

Poland added to Visa Waiver Country List

As of Nov. 11, 2019, Poland is eligible to participate in the Visa Waiver Program (VWP). The VWP allows eligible citizens, nationals, and passport holders from designated VWP countries to apply for admission to the United States at ports of entry without first obtaining a visa. Individuals admitted under the VWP may enter for up to ninety days for business or pleasure if they are otherwise eligible for admission. In addition, if admitted under the VWP, an individual is not eligible to extend their stay in the U.S., nor may they change to another type of status within the U.S.

E-Verify Data Disposal Scheduled

USCIS is scheduled to dispose of E-Verify data dated on or before Dec. 31, 2009. Employers who have case records on or before that date must retain this case information by obtaining a Historic Records Report before Jan. 2, 2020. Employers can learn how to download the report by reviewing the instructions to download.

*Alicia Visse-Kroger contributed to this article.