Insurance Coverage & Bad Faith

Experience matters in coverage matters.

Insurance coverage and extra-contractual (or bad faith) litigation goes to the very heart of a company’s business operations, reputation, and products sold to protect policyholders from risk. While insurance products are essential to our modern life and business opportunities, the public often perceives — and the media portrays — insurance companies as uncaring corporate giants. These unique and sensitive aspects mean that coverage and bad faith litigation is often about honesty and integrity. We identify ways to aggressively defend our clients and their claim professionals — to level the playing field and win or resolve matters based on the facts.

How We Help Clients

Risk management through insurance is one of the greatest human innovations. But most jurors and many judges do not understand this, or the role of insurance products in managing personal and business risks. Experience tells us that success with a judge during motion practice, before a jury, and even with a mediator often requires showing a simple reason why it is fair for an insurance company to prevail. It is therefore important to educate fact-finders about how insurance products work, why insurance companies investigate claims, and how companies apply policy terms and exclusions. In some cases, our most important work is carefully selecting a corporate representative to be the face of the company in court, preparing them to testify, and aggressively narrowing topics for testimony.

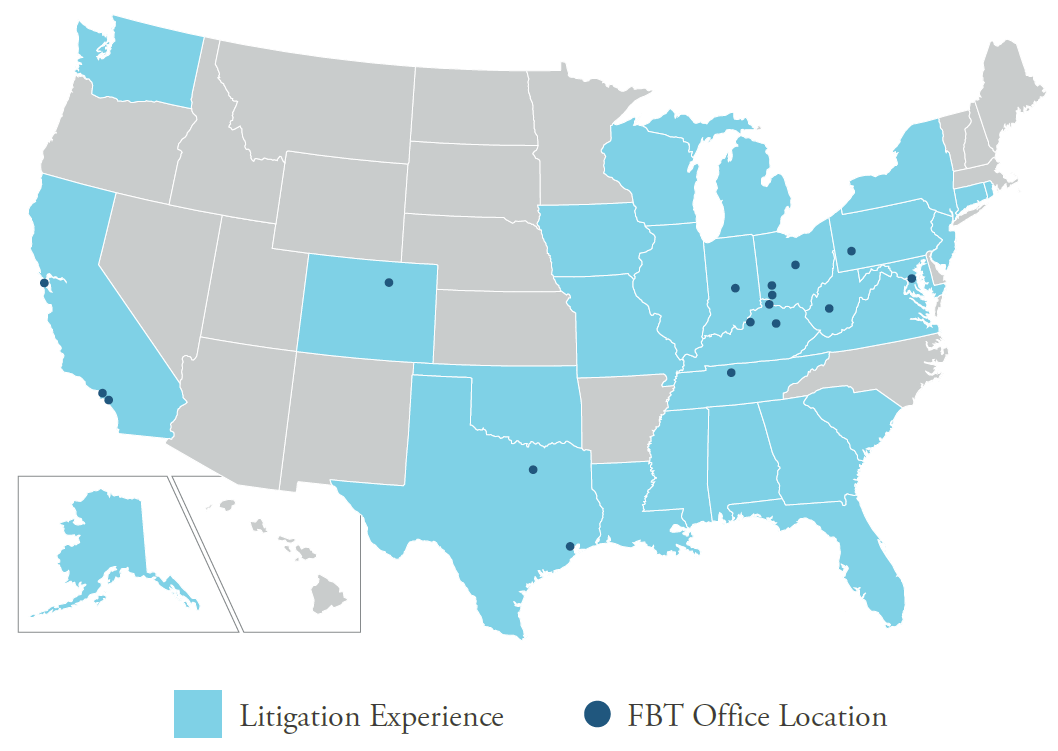

With thousands of coverage opinions and hundreds of coverage and bad faith cases in over 20 jurisdictions, our unsurpassed experience, along with creative analysis and a client focus, helps us successfully resolve a wide range of matters: sensitive fraud investigations, Covid-19, PFAS, construction defects, and other complex coverage issues.

We also appreciate the importance of controlling transactional costs, starting with adherence to billing guidelines, evaluation of damages and settlement potential for early case assessments, and preparation of budgets — all with an eye towards an early resolution strategy, where appropriate. And we couple our experience with the use of technology to improve our work product, assist with our analysis, and increase efficiency.

Early assessment is vital for efficient resolution of any coverage or extra-contractual matter. On coverage opinions, we work with claims professionals to investigate facts, gather claim and underwriting file materials, and research applicable law. Our focus is always forward-looking: avoid litigation or prepare for success if litigation is necessary.

Many law firms have insurance litigation teams. We’re not ones to just get the job done. Rather, we exceed expectations and deliver value by working meticulously, efficiently, and passionately. Dedicated to refining the art of client service, we leverage technical, industry, and legal knowledge with hands-on experience to succeed in insurance and bad faith litigation, from the outset of an engagement through its successful resolution.

Early Assessment & Trial Execution

- Preserve electronic documents: emails, texts, and claim and underwriting files.

- Prepare early case assessments, budgets, and early resolution plans, with damages and settlement valuations.

- Evaluate dispositive motions and likelihood of success.

- Protect privilege.

- Interview witnesses early to preserve memories.

- Select and prepare company witnesses.

- Identify any needed experts and third-party documents.

- Select an evaluative mediator who will work aggressively with both sides to settle the case.

- Develop a comprehensive and persuasive trial strategy to defend the company and its policies.

- Identify and preserve errors as needed for appeal and to create favorable precedent.

Experience Highlights

Gardner v. Liberty Insurance Corporation, No. 3:20-cv-147, 2023 WL 7002781 (S.D. Ohio Oct. 23, 2023) (jury verdict for insurer based on defense of insured’s material misrepresentation).

Sinmier LLC v. Everest Indemnity Insurance Company et al., No. 3:19-cv-2854, 2023 WL 6258591 (N.D. Ohio Sept. 26, 2023) (granting summary judgment to builder’s risk insurer on $34 million coverage claim based on finding that policyholder’s failure to pay the first premium resulted in no contract ever being formed).

Dow v. Liberty Insurance Corporation, No. 3:19-0486, 2022 WL 17365258 (S.D. W. Va. Dec. 1, 2022) (summary judgment on first impression coverage issues involving water loss exclusion and bad faith).

Sellman v. Safeco Insurance Company of America, No. 5:21-cv-192, 2022 WL 4598571 (N.D. W. Va. July 25, 2022) (summary judgment on coverage issues and defense jury verdict on common law and statutory bad faith claims).

Selective Insurance Company of South Carolina v. Devoted Senior Care LLC, No. 4:21-cv-00051, 2022 WL 1036782 (W.D. Ky. April 6, 2022) (summary judgment on coverage because damages did not result from advertising injury or defamation).

Greenbank v. Great American Assurance Company, 47 F.4th 618 (7th Cir. 2022) (affirming summary judgment for insurer on claims for breach of contract, criminal conversion, theft, and bad faith in equine mortality matter).

Isaacs v. Fireman’s Fund Insurance Company, No. 2021-CA-0545, 2022 WL 495980 (Ky. App. 2022) (affirming dismissal of bad faith claims by a high-profile plaintiff, expanding precedent to first-party context, rejecting arguments that bad faith claims required additional discovery).

Mosley v. Arch Specialty Insurance Company, 626 S.W.3d 579 (Ky. 2021) (landmark decision affirming dismissal of bad faith claims, confirming a plaintiff’s “steep burden” of proof, and emphasizing insurer’s right to contest liability).

1210 McGavock Street Hospitality Partners, LLC v. Admiral Indemnity Company, 509 F. Supp. 3d 1032 (M.D. Tenn. 2020) (dismissing restaurant’s breach of contract claims arising from COVID-19 closure based on policy virus exclusion, failure to prove property damage or limit access to property under civil authority clause).

Liberty Mutual Insurance Company v. Estate of Bobzien ex rel. Hart, 377 F. Supp. 3d 723 (W.D. Ky. 2019) (granting summary judgment to insurer in declaratory judgment action on duty to defend $50 million underlying injury lawsuit under more than forty homeowners, condominium, and personal excess liability policies), aff’d, 798 F. App’x 930 (6th Cir. 2020)

United Specialty Insurance Company v. Cole’s Place, Inc., 936 F.3d 386 (6th Cir. 2019) (holding federal court jurisdiction over insurer’s declaratory judgment action was proper under Sixth Circuit factors, and affirming summary judgment for insurer on claims of alleged bad faith and duty to defend nightclub in four underlying injury lawsuits arising out of a shooting incident)

Arla v. Liberty Mutual Group, Inc., 715 F. App’x 517 (6th Cir. 2018) (affirming summary judgment for insurer on breach of contract and bad faith claims arising out of fire loss under builders risk policy)

MJW Crazy Willy’s, Inc. v. Halloween Express LLC, No. 12–cv–01496, 2013 WL 1130719 (D.Colo. 2013) (breach of contract claim dismissed; other claims ordered to arbitration).

Great American Insurance Company v. Brock Construction Company, Inc., No. Civ.A. 05-0569, 2007 WL 2844945 (E.D. Ky. Sept. 28, 2007) (summary judgment because insured did not submit timely proof of loss, produce requested documents, and likely made material misrepresentations during the claim investigation).

One Beacon Insurance Company v. Chiusolo, No. 5:05-201, 2007 WL 1728707 (E.D. Ky. June 13, 2007) (summary judgment based on policyholder’s misrepresentation in application and failure to submit timely proof of loss).

Express Textile Consultants Inc. v. General Accident Insurance Company of America, 22 F. App’x. 747, 2001 WL 1356833 (9th Cir. 2001) (affirming jury verdict voiding coverage based on policyholder’s misrepresentations, holding that materiality of misrepresentations are judged from the insurer’s perspective, allowing recovery of previous fire loss settlement).

Assurance Company of America. v. Dusel Builders, Inc., 78 F. Supp. 2d 607 (W.D. Ky. 1999) (summary judgment because CGL policy does act as a performance bond and claims were not for property damage).

Core CapabilitiesWhatever the need, from arson and fraud investigations to cutting-edge claims, we got you covered. |

||

|

|

|

Coast-to-Coast Experience

Clients rely on Frost Brown Todd as a go-to law firm for insurance and bad faith litigation. We earned this trust by litigating coverage and bad faith cases in our core footprint and over 25 other states.

Stay ahead of the law.

Subscribe to receive email updates and choose your topics.