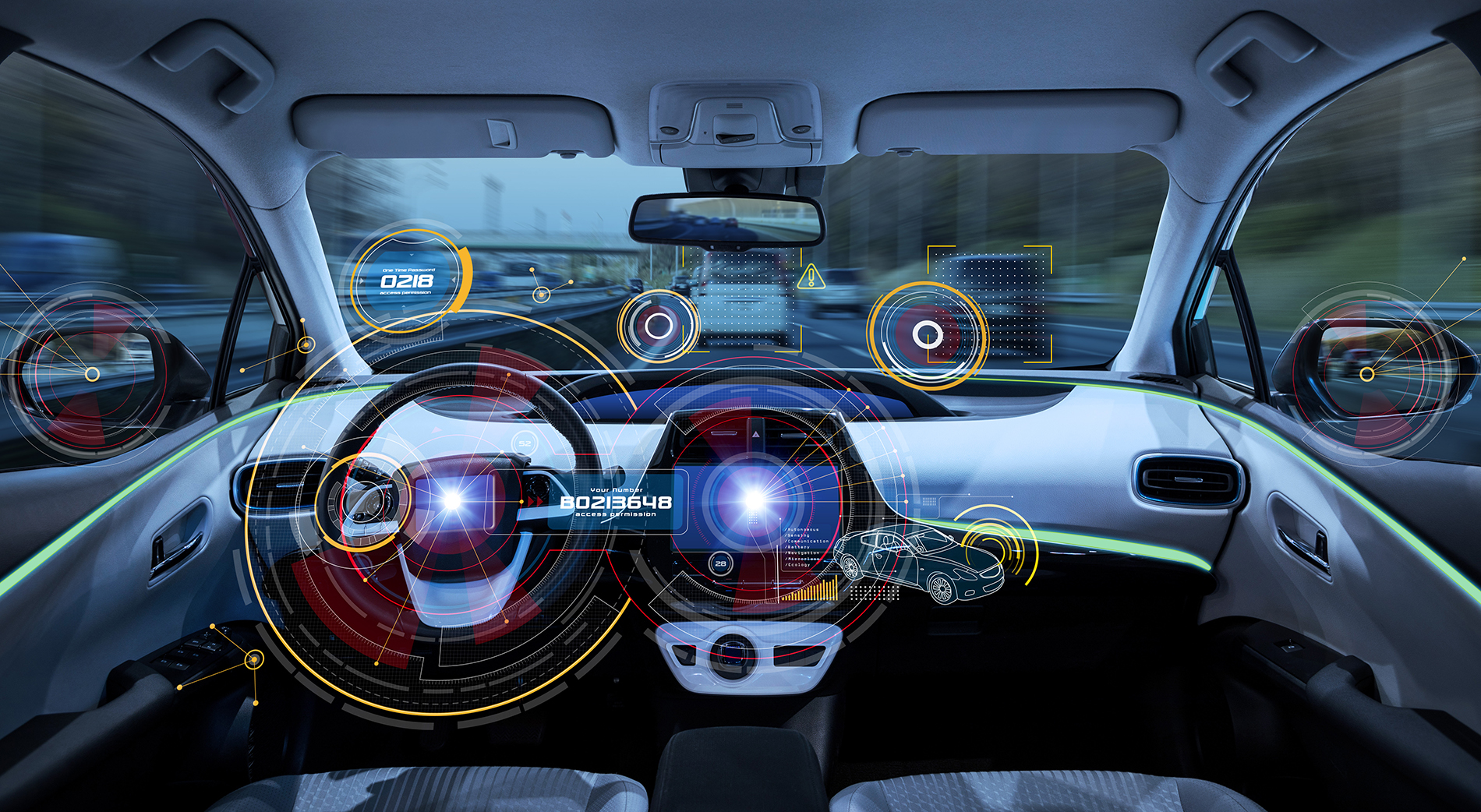

In today’s world of ever-expanding technology, the evolution of autonomous vehicles from theory, to concept, to testing, to the start of actual implementation will come as no surprise. From Tesla’s now-standard autopilot mode to an Intel subsidiary launching test fleets of autonomous vehicles, the evolution of advanced driver-assistance and driver-less features will likely make manual-drive vehicles a thing of our past. Soon, the use of autonomous vehicles will be a common everyday occurrence, from fleets of autonomous vehicles providing ridesharing opportunities, to companies shipping items across the country with the use of driverless trucks. This technological advancement provides opportunities for both new revenue streams and areas of potential risk.

Autonomous Vehicle Evolution

The Society of Automotive Engineers and the National Highway Traffic Safety Administration recognize six separate tiers of autonomous driving capabilities in vehicles. This begins at Level 0, which has no autonomy, and proceeds to Level 5—full automation with no manual interaction. Currently, the U.S. has vehicles operating from levels 0-2. A Chinese carmaker has recently stated that it will soon be offering the first-ever Level 3 autonomous vehicle. This will allow drivers to fully take their attention off the road and only be prepared to intervene when the vehicle is unable to execute certain tasks.

As industry innovators push towards greater levels of automation, successful market operators must be able to create new opportunities under the current lower automation levels. If danger appears on the road, is the driver required to override the autopilot and attempt to take back control? Does the owner/driver need to still maintain insurance for driver failure, or can the owner/driver look to the automated vehicle OEM and suppliers, including technology/software companies, as to liability? Alternatively, if the driver takes control and an accident still occurs, what liability does the automated vehicle OEM and supply chain retain? Stakeholders across the automotive industry will each need to have clear risk management strategies to handle such issues.

Changes to the Existing Framework

In the next five to ten years, when vehicles move into the range of full autonomy, there will be an even greater necessity to review how new technology may impact a company’s risk assessment. To recognize any potential future impacts, we must first understand the current system used in today’s automotive world. Under the current model, state laws typically require drivers to maintain certain minimum auto insurance policies to legally drive on their roads. This protects individuals from suffering substantial liability in the event of a vehicle accident and provides victims of vehicle crashes with adequate compensation. In any lawsuit regarding liability, traditional concepts of negligence will apply, such as whether the driver maintained a safe speed, whether a traffic violation was involved, or if the other driver contributed to the accident in some way. Now, in the world of autonomous vehicles, this liability cannot be so easily determined.

Until new theories of liability can be developed, it is likely that all related parties will be dragged into court when causation is not readily apparent. Each party will then be required to demonstrate that they were not the cause of the accident, a process that can be expensive and time-consuming. Groups are working hard to find alternative solutions to this potential problem, such as a global no-fault insurance system or the use of game theory to determine liability. While these theories are being further developed and tested, companies involved in the autonomous vehicle space will likely need to prepare for litigation regarding any potential liability.

Software companies, data providers, OEMs, suppliers, and vehicle manufacturers will likely struggle to establish that their technology was not the cause of an autonomous vehicle accident. In 2018, the National Transportation Safety Board found that the autonomous vehicle company owner and developer (Uber), the victim, the safety driver in the vehicle, and the state of Arizona were all to blame for the fatal crash between an autonomous vehicle and another vehicle. This demonstrates that companies who need to conduct a risk assessment will not only be typical automotive industry players, such as vehicle manufacturers and OEMs, but will represent a whole new segment of the industry.

In addition to liability in the event of autonomous car accidents, companies will now need to provide additional business risk strategies. Current general corporate liability policies will not adequately cover the new risks which will arise in the autonomous vehicle industry. As the automotive industry advances into the world of driver-less vehicles, new types of cybersecurity and product liabilities policies will be commonplace for the automotive industry. It will be important that new companies in this industry adequately protect themselves to ensure that they remain in the marketplace.

New Players in the Industry

Companies that program driving algorithms, software developers, companies that build components used in the autonomous vehicle, and data providers will now need to have insurance and risk allocation plans and business protections for autonomous vehicle accidents. Some companies develop their autonomous vehicle technology themselves, like Tesla. While technically automotive manufacturers, companies like Tesla have redefined the sector and themselves as part of the broader tech industry. They will utilize their knowledge in both the automotive industry and the tech industry to provide value-adding services to both business-to-business and direct-to-consumer customers.

Housing both the technology and auto manufacturing in the same company will double the company’s risk. Some vehicle manufacturers such as Volvo or Mercedes have already indicated that they will accept full liability in the event of a crash caused by a flaw in the vehicle’s design. If the company is also the software manufacturer, this removes another party with which the liability can rest. Companies who utilize both software development and automotive manufacturing will need to ensure that they recognize this risk and take the necessary steps to complete appropriate risk allocation strategies.

Other manufactures are working with outside vendors to create and maintain the necessary software to run the vehicle. Outsourcing this work to typical software companies will capture a significant amount of new companies into the automotive space, forcing them to quickly adapt to the new business landscape in order to ensure that business opportunities are maximized and potential risks are minimized. Even in the event a manufacturer maintains the software development in-house, autonomous vehicles providers will still need to work hand-in-hand with third-party data providers to ensure that their vehicles run smoothly on the road. Data providers will need to input GPS positions and ensure that proper traffic laws are followed. While the provision of mapping services is nothing new for data providers like Google, this service will create a significant amount of liability. If a data provider gets any one of the required inputs wrong or fails to timely reflect changes to traffic laws or other considerations, then the data providers could also bear liability in the event of an accident.

Software Considerations

When developing software for an autonomous vehicle program, it will be extremely important to review the language that is included in the end-user license agreement (EULA). EULAs are commonplace in today’s world of cellphones and laptops, and many consumers simply click their way through without fully reading. But what if the liability of an autonomous driving vehicle dispute is tied into the disclosures used in the EULA? It will be particularly important that each party involved in the creation of the EULA has intimate knowledge of what risk is being shifted and who will ultimately bear that risk in the event of an accident.

On top of monitoring disclosures utilized in EULAs provided to consumers upon the initial purchase of an autonomous vehicle, software developers will also likely bear an ongoing responsibility to provide continued software updates to the vehicle. These updates will be critical for ensuring the smooth operation of the autonomous vehicle and will be made hand-in-hand with the data providers who are inputting the necessary mapping and regulatory data to the vehicle. This responsibility opens the door for another area of potential risk, as the failure to provide a critical update which causes improper data to be received could lead to possible crashes.

Software companies will also need to evaluate strategies on how previous software is supported and maintained. As companies begin to “sunset” older software systems, these systems become more vulnerable to failures or potential hacking. While software sunsets may not be critical for inexpensive laptops or tablets, the maintenance of older software will be crucial for safe operation of autonomous vehicles. Any failure to ensure compatibility with older software could lead to significant consumer issues, provided that new vehicles are not purchased as often as an obsolete laptop or cell phone.

Conclusion

The rise in use of autonomous vehicles will bring a substantial amount of new considerations for companies who were typically not involved in the automotive industry. While autonomous vehicles provide for new business opportunities and revenue streams, they also bring new obligations and potential risks. If these risks are managed correctly, traditional “tech” companies will thrive in this market.

Questions? Contact Greg Mitchell or Matt Wagner of Frost Brown Todd’s Insurance and Mobility & Transportation industry teams.